Estate Planning Attorney in San Diego, CA

While nobody wants to think about disability or death, setting up an estate plan is one of the most vital steps you can take to protect yourself and your family. A well-created estate plan can help you have better control over your finances and spare your loved ones from the expense, hassle, and delay in managing your affairs when you pass away or become disabled.

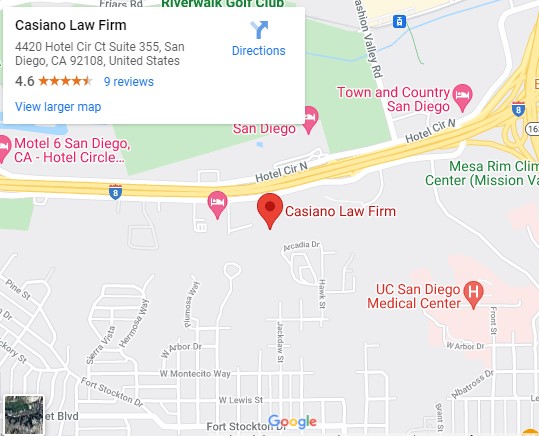

San Diego estate litigation attorney Vincent Casiano can provide the legal assistance you need to care for your family. If you want to find the best estate plan for your family, schedule a consultation today with Vincent Casiano!

Why Estate Planning is Important

In this Ask the Lawyers interview, Vinny discusses the significance of estate planning and long-term care planning. He says that you don’t have to wait until you’re sick and too old to handle your estate. The Advanced Health Directive was another topic that Attorney Vincent Casiano commented on.

Why Every Family in San Diego Needs an Estate Plan

Estate planning is not just for the rich or the elderly. Every California family needs an estate plan to help protect their family if the unthinkable happens. Ask yourself these questions to see if you are all set with whatever happens in the future:

- What will happen to your loved ones if you suddenly die or become incapacitated?

- What if a simple accident puts your home or your business at risk?

- How do you ensure that your final wishes are carried out?

- How do you ensure that your family’s future is protected?

Save your family from unnecessary heartache and expenses by creating your estate plan today.

How Do You Create an Estate Plan in California?

An ideal California estate plan is a carefully prepared set of documents that includes a Will, Living Trust, Durable Power of Attorney for healthcare and finances, Living Will, Advance Healthcare Directives, Guardianship, and more. These documents must be signed and stored correctly to be recognized as legal when you die or become incapacitated.

With Attorney Vincent Casiano, individuals and families are informed on various estate planning strategies to make the best decisions for their families. Vinny Casiano also educates California residents about estate tax settlement, trust administration, and identification of a guardian or trustee for their beneficiaries.

If you want to create a sound financial plan and asset protection, avoid probate, and other costly legal expenses, schedule a consultation with Attorney Vincent Casiano now!

(619) 800-6820

Creating a Last Will and Testament in San Diego, CA

The most popular form of estate planning tool is a will. A last will and testament, or a will, states your final wishes. The court reads it after you pass away, ensuring that your last wishes are carried out. By creating a will, you can:

- Give your property to your loved ones or organizations.

- Name an executor who will carry out the terms in your will.

- Name a guardian for your minor children and the property you will leave for them.

- Direct how they will pay your debts and taxes

- Provide for your pets

What are the legal requirements in creating a will?

Creating a will is not complicated, and there are a few legal requirements that you must meet:

- Know what properties and assets you have and what it means to leave them behind to someone else after you pass away. This is known as having “capacity” or being of “sound mind.”

- Create a document that lists your beneficiaries

- Sign the document

- Have two witnesses sign the document

A legally binding last will and testament will save your family the trouble of worrying about your estate after your death. You can also place your assets in a trust and name your beneficiaries, but a simple will is enough for most people. An experienced estate planning lawyer in California can help explain your options to you.

(619) 800-6820

What is a Trust?

A living trust is at the core of an estate plan for most people. Depending on their situation, an attorney can create separate living trusts for spouses or joint trusts. It is called a living trust because it takes effect even while you’re still alive.

You can place certain assets in a living trust so you and your “successor trustees” can control those assets. An experienced living trust attorney can help you prepare for your death or incapacity, as well as express your final wishes, through a living trust.

Revocable Living Trusts

Avoiding probate after your death can essentially save your loved ones money, time, and unnecessary hardship. A revocable trust can help you avoid probate for any property you own, such as real estate, bank accounts, jewelry and heirlooms, and more. They function similarly to a will, and you can change the terms of the trust or revoke it while you’re still alive.

The trustee controls the assets in a trust, and they have the power to distribute your assets to your beneficiaries or inheritors without going through probate. If you’re looking for legal help to establish or administer a trust, speak with a San Diego estate planning attorney by filling out the form here.

(619) 800-6820

What is Probate?

Probate takes place after someone dies. It includes proving in court that the deceased person’s will is valid, identifying and appraising their properties, paying taxes and debts, and distributing the property as the will or California state laws direct.

Who is responsible for handling the probate process?

In most cases, the executor named in the will handles the probate. If there’s no will or the will has no executor, then the probate court assigns an administrator to manage the probate process. Usually, they designate a family member, close relative, or the biggest beneficiary of the estate as the estate administrator. Dealing with probate law can be complicated, but Vincent Casiano can help you and your family deal with probate. Schedule a consultation with him today so he can give you sound legal advice.

How do I avoid the probate process in California?

Probate is usually a lengthy and complicated process that your loved ones don’t necessarily have to go through. The probate process can be costly. It can include probate lawyer fees, executor fees, court costs, appraiser fees, and other expenses.

Given these reasons, it is best to avoid probate altogether, or at least consider reducing the number of assets that will be subject to probate once you die to lessen the fees and distribute your assets to your beneficiaries faster. You can avoid probate by doing any of the following:

- Creating a revocable living trust

- Converting your bank accounts to payable-on-death accounts

- Owning property through joint tenancy with right of ownership

- Owning property through community property with right of survivorship

- Giving away your property as gifts while you’re still alive

(619) 800-6820

How Do I Provide for My Minor Children?

If you have minor children, you must address their upbringing in your estate plan. Implementing a plan that allows your surviving spouse to give more attention to your children without the burden of financially providing for them can help them move forward in life more easily.

You should also consider the possibility of you and your spouse dying simultaneously and assign a guardian for your children and your assets. The person in charge of your estate and children need not be the same. It is best if you assign different individuals to maintain accountability.

How Do I Prepare for My Future Healthcare and Finances?

Nobody wants to be involved in an accident or an unexpected illness, but sometimes they are unavoidable. If an accident, illness, or old age leaves you incapable of making certain decisions for your healthcare or finances, a power of attorney can help make life easier not just for you but also for your family.

(619) 800-6820

Advance Healthcare Directive

An advance healthcare directive is a legal document where you name a person to oversee your medical care if you’re no longer able to do so. This will provide detailed instructions to your appointed agent and health care providers for your long-term care.

(619) 800-6820

Financial Power of Attorney

If you’re ill or injured, someone has to step in and care for your finances. By creating a financial power of attorney, you can assign someone to pay your bills, manage your bank accounts and investments, collect your insurance or government benefits, and handle other money matters in your stead.

(619) 800-6820

Here is Why You Need an Estate Planning Attorney

Vinny discusses various real-life scenarios in this video that will make you realize how urgently you need estate planning. He also explains how an estate planning lawyer can give you sound legal counsel so that your wills and trusts are properly structured.

Why Choose Casiano Law Firm as Your Estate Planning Partner

Taking care of your family’s future can be overwhelming. You need to consider many factors to create an effective estate plan. An experienced San Diego estate planning attorney can advise you on the best estate plan for you and your family. If you choose Attorney Vincent Casiano as your partner in protecting your family and estate, Vinny will ensure that all your wishes are carried out while avoiding unnecessary hassles and expenses.

If you’re ready to create the best estate plan for your family, don’t hesitate to schedule an appointment. Vinny will provide you with all the information you need to make informed decisions for your future.

Don’t wait until it is too late! Talk to a San Diego estate planning attorney and address all your estate planning needs today.